People Are Making Fun Of ‘Rich’ People Who Are Afraid Of Biden’s Tax Plan (46 Pics)

Even though the votes are still being counted and the US presidential election results aren’t final, some Americans are already celebrating what seems to be former Vice-President Joe Biden’s victory. Now, they’re taking a closer look at the politician’s policies. And one of them is increasing taxes. Naturally, when people hear about tax increases, they tend to panic (and blame 2020). But in this case, Biden pledged not to raise taxes on anyone earning less than 400k dollars per year. In other words, around 90 percent of taxpayers would be safe from the tax hike.

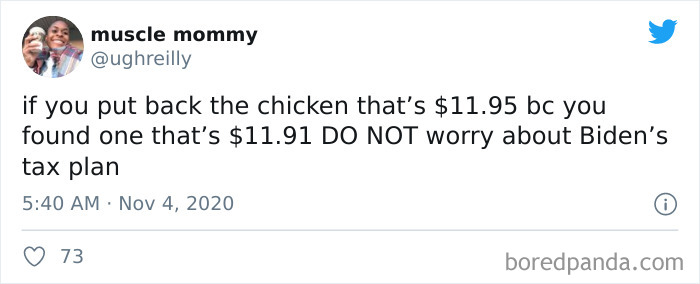

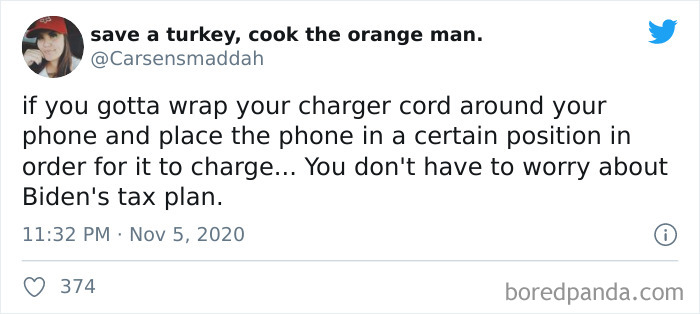

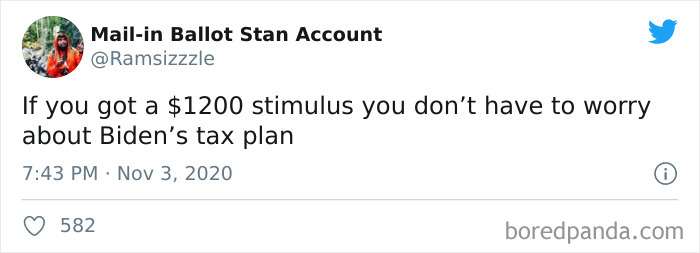

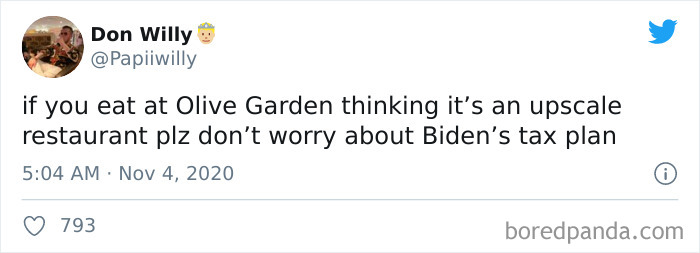

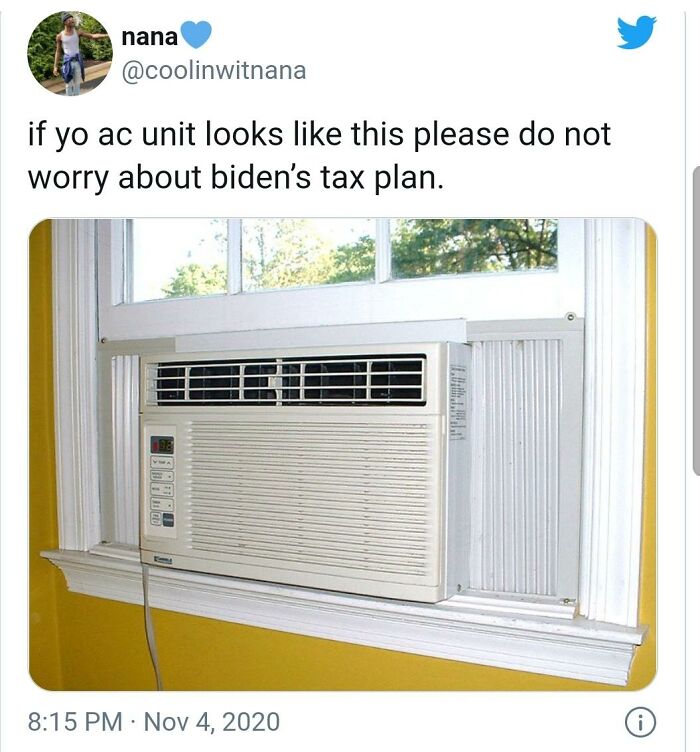

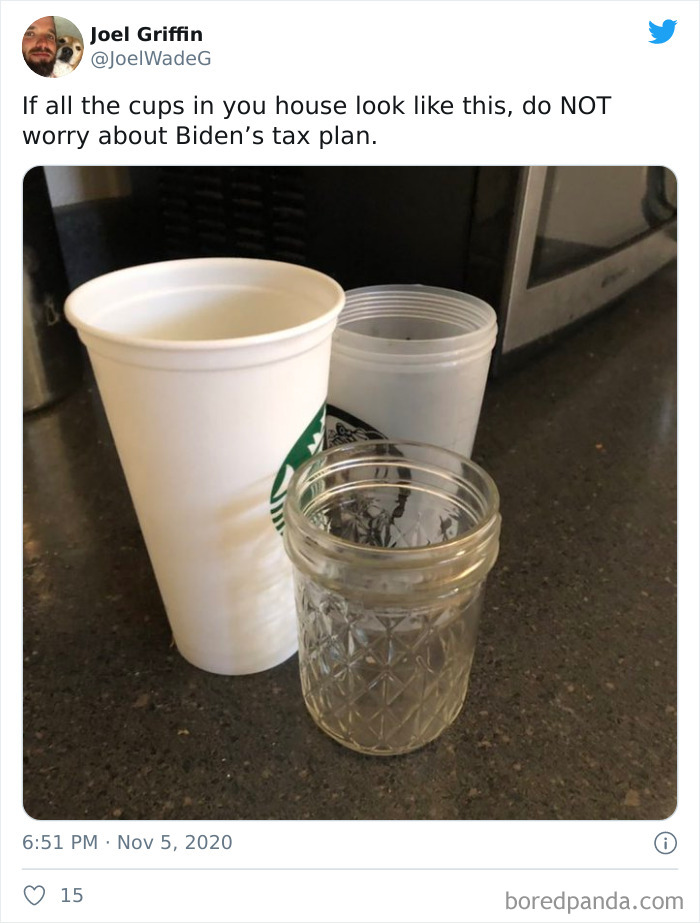

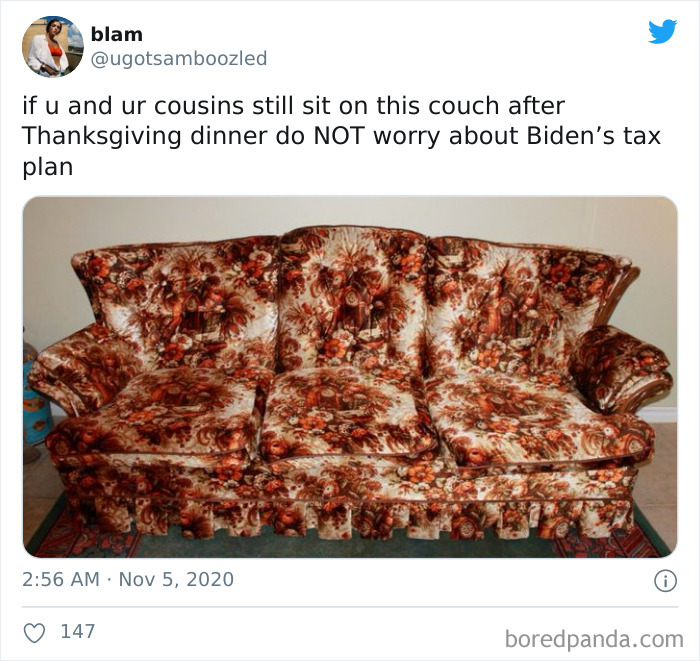

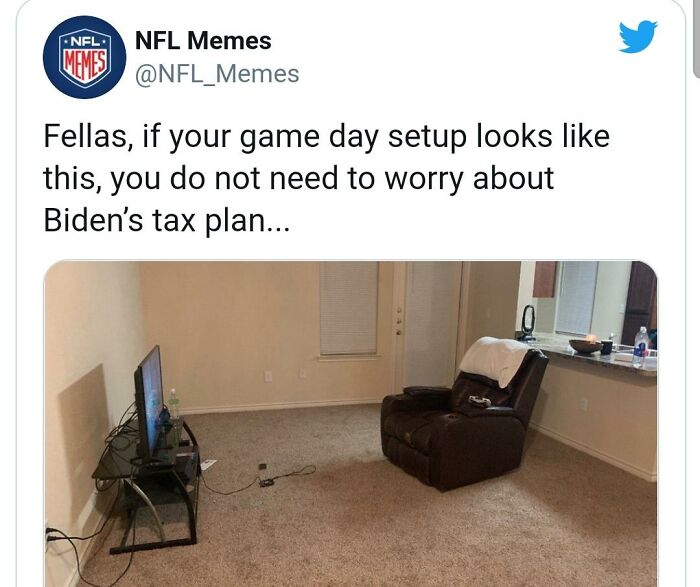

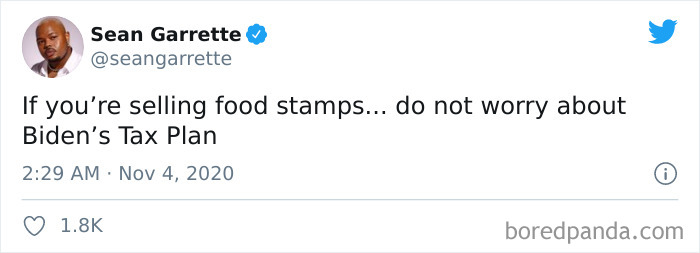

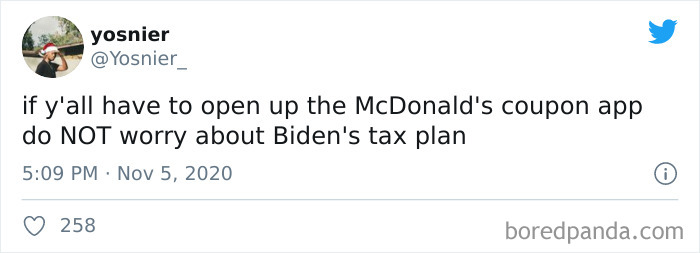

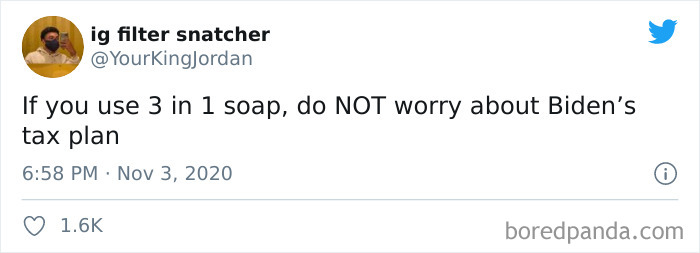

Twitter users had a lot of fun showing that the vast majority of Americans had nothing to worry about by posting examples from their lives and how you can tell that Biden’s tax hike won’t affect you. Scroll down to check out the funniest ones and remember to upvote your fave tweets. Let us know in the comment section which of these tweets you relate to the most.

David Alexander Bateman, the Director of Undergraduate Studies at the Department of Government at Cornell University, told that almost all presidents try to make changes to the US tax system. "After all, Trump supported the far-right tax plans of Paul Ryan, which amounted to one of the largest upward redistributions in American history. Obama tried and succeeded in very slightly raising taxes. Bush presided over several tax cuts, and Clinton and G. H. W. Bush both presided over modest increases in taxes." Read on for Bateman's full insights and the fact that it's almost guaranteed that Biden is the winner of the elections.

Joe Biden plans to increase taxes for the wealthy and for corporations. However, some Americans were still worried

Image credits: Joe Biden

He added that Biden's plans might actually be criticized as not sufficiently aggressive and not aiming to raise top tax rates enough, limiting the raise to the already "extremely wealthy," instead of the "broader affluent middle classes." Bateman highlighted that many economists estimate that the "optimal rate" for high earners would be around 70 percent which is still below the 90 percent top rate that existed during the mid-20th century. "There is a lot of pushback against this by conservative and industry-backed think tanks, but the logic is sound," Bateman said.

"Even Obama, after all, sought to raise taxes on those making over 250,000 dollars which at the time was seen by many as insufficient to finance the public services a productive country requires," Bateman told Bored Panda.

"The norm in US national elections is that it takes a few weeks before all the votes are counted, largely because there are so many jurisdictions doing the counting, so many different ways in which ballots can be cast—including provisional ballots, which aren't even touched for days after the election—and because most jurisdictions are under-funded relative to the demands that are placed upon them," Bateman explained.

However, the results in some states can still take a while to process. "But even if the election is called later today, we won't know close states such as Georgia for a while, in part because in many states ballots are still arriving—military ballots can arrive in Georgia, for example, up to 9 days after the election."

However, because of how interconnected economic systems are, those earning less than 400k dollars per year could still see an average decrease in after-tax income of 0.9 percent. Compare that to around a 17.7 percent decrease of after-tax income for those earning more than 400k dollars.

So it's not technically true that the tax changes won't affect all Americans, but the changes vary greatly depending on how much you earn. But like with most things, we won't know how the entire system is affected until after the changes have already been made (if Biden's proposed changes will go through).

Overall, these and other changes to the tax system could raise the United States anywhere from 2.4 trillion dollars and 4 trillion dollars over 10 years. What’s then done with this money is a whole other issue altogether.